As financial institutions (FIs) defend against increasingly sophisticated criminal tactics, AI is becoming a critical differentiator. This transformation is particularly notable in the anti-money laundering (AML) space. In fact, experts predict the AML market will balloon to $16.37 billion by 2033, up from $3.18 billion in 2023. AI will be an important factor in the growth of AML solutions market share.

The AI Advantage in AML

AI brings three key advantages in the realm of AML:

- Enhanced data processing: AI systems can operate continuously, processing vast amounts of data from diverse sources at unprecedented speeds compared to humans. This capability allows for a more comprehensive and timely analysis of potential risks.

- Intelligent risk analysis: AI can significantly reduce false positives and prioritize genuine risks by leveraging machine learning (ML). This context-aware approach enables compliance teams to focus their human efforts more effectively.

- Streamlined due diligence: AI can automate risk classification and profiling, enabling faster and more targeted customer due diligence. This not only accelerates the onboarding process for low-risk customers but also allows for more thorough scrutiny of high-risk entities.

AI in Action: Transforming AML Processes

AI stands to transform AML processes in the following areas.

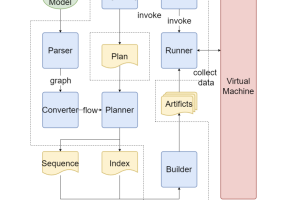

Data Scanning and Filtering

Traditional keyword-based scanning tools often fall short in today’s complex digital ecosystem, which spans a diverse set of data, from social media to news articles. In this environment, keyword matching tools may miss behaviors that indicate fraud-related activities. AI-powered solutions, however, can sift through structured and unstructured data from many more sources, including internal databases, transaction records, and online forums. By employing advanced natural language processing (NLP) and ML techniques, these AI systems can understand context and surface relevant information that may warrant further investigation.

Contextual Risk Assessment

AI’s ability to understand context is a game-changer for risk assessment. Unlike rigid rule-based systems, AI can analyze the nuances of language and situation, dramatically reducing false positives. For instance, when searching for terms like “impersonator,” an AI system can distinguish between mentions of fraudulent activity and benign references to entertainers, saving compliance teams valuable time and resources.

Intelligent Due Diligence

Beyond initial risk identification, AI is revolutionizing the due diligence process itself. By classifying findings into risk categories such as financial crime, fraud, corruption, or terrorism-financing, AI can help compliance teams prioritize their efforts more effectively. This risk profiling capability helps ensures that resources are allocated to the most critical issues first, enhancing the overall efficiency of AML operations.

Challenges and Considerations

While AI offers tremendous potential in the AML space, its implementation is not without challenges. Considerations here include:

- Ethical concerns: The use of AI in financial crime prevention raises important questions about bias and fairness. FIs must ensure their AI systems are developed and deployed ethically, with regular audits to check for and mitigate bias.

- Privacy issues: The vast amount of data processed by AI systems necessitates a careful balance between effective crime prevention and respect for individual privacy rights.

- Human oversight: Despite AI’s capabilities, human expertise remains crucial. The most effective AML strategies will likely involve an alignment of AI technologies and human analysts, combining machine precision with human intuition and industry knowledge.

The Road Ahead

As AI technologies continue to evolve, we can expect even more sophisticated applications in the fight against financial crime. Further advancements in NLP, for example, could lead to AI systems capable of analyzing communication patterns associated with complex, multi-party financial schemes.

However, it’s important to note that AI is not a panacea. The most robust approach to financial crime prevention will involve a thoughtful integration of AI capabilities with human expertise and traditional AML methods.

About the Author

Vall Herard is the CEO of Saifr.ai, a Fidelity labs company. He brings extensive experience and subject matter expertise to this topic and can shed light on where the industry is headed, as well as what industry participants should anticipate for the future of AI. Throughout his career, he’s seen the evolution in the use of AI within the financial services industry. Vall has previously worked at top banks such as BNY Mellon, BNP Paribas, UBS Investment Bank, and more. Vall holds an MS in Quantitative Finance from New York University (NYU) and a certificate in data & AI from the Massachusetts Institute of Technology (MIT) and a BS in Mathematical Economics from Syracuse and Pace Universities.

Sign up for the free insideAI News newsletter.

Join us on Twitter: https://twitter.com/InsideBigData1

Join us on LinkedIn: https://www.linkedin.com/company/insideainews/

Join us on Facebook: https://www.facebook.com/insideAINEWSNOW