In the fast-paced world of insurance, handling claims is both an art and a science. The goal is not just to process claims faster but to do so with precision, prioritizing critical information that directly impacts outcomes. However, claims professionals are often flooded with mountains of documents, making it nearly impossible to manually sift through every detail. From return-to-work status updates to complex medical records, every piece of data is crucial, but not all of it is relevant at every stage of the claim. So, how do we streamline this process to ensure the best results?

Enter claims automation powered by AI. With advanced language processing, expert.ai’s hybrid AI solutions are revolutionizing the claims review process, saving insurers valuable time, reducing inefficiencies, and ultimately enhancing customer satisfaction. Here’s a closer look at how our AI solutions address the top challenges in claims processing.

The Challenge: Complex Data, Limited Time

Claims handlers today face intense workloads, with each professional managing upwards of 80 to 150 claims at a time. Each claim brings its own package of documents, from structured forms to unstructured medical records and even subpoenas. Reviewing these documents manually is time consuming, often taking days to extract key details needed for informed decision making. With tenured SMEs approaching retirement and an estimated industry-wide efficiency loss of up to $160 billion due to administrative tasks, the demand for faster, smarter claims processing has never been greater.

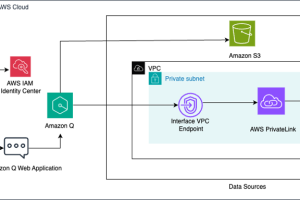

Claims management isn’t just about reading documents; it’s about identifying risks, spotting red flags, and intervening at crucial moments. To keep up with increasing claim complexity and volume, insurers need a solution that can accurately and efficiently handle massive amounts of language data. This is where expert.ai’s hybrid AI technology shines, leveraging a combination of knowledge-based AI, machine learning (ML) and Large Language Model (LLM) capabilities to provide a comprehensive view of each claim’s most essential information.

The Solution: Hybrid AI-Powered Claims Automation

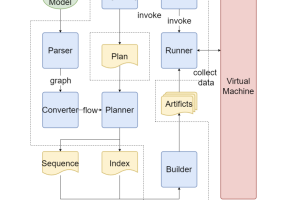

With expert.ai’s hybrid AI approach, claims handlers can finally take control of the data challenge. Our platform leverages both rule-based systems and machine learning techniques, allowing it to parse different document types with unparalleled accuracy and explainability. Here’s how it works:

- Automating Document Review: With AI, we quickly identify critical information in many document types, from accident reports to medical records, ensuring that handlers only focus on what truly matters. This streamlines the process, allowing for faster decisions and enabling claims professionals to prioritize urgent and severe claims over less pressing ones.

- Extracting Key Information: Hybrid AI is particularly effective in understanding nuanced information, such as medical terminology and insurance jargon. By embedding domain expertise within our models, we ensure accuracy and reliability—metrics essential to maintaining quality in the claims process.

- Improving Workflow Efficiency: With AI handling the heavy lifting of document review, claims adjusters can concentrate on high-value tasks like evaluating treatments, monitoring work status and identifying unrelated conditions. This empowers insurers to speed up the claims process without compromising accuracy while delivering empathy and outstanding experience to their client.

- Empowering Claims Professionals: Our hybrid AI platform is designed to work in tandem with claims professionals, not replace them. By providing clear, explainable insights, it enables handlers to make informed, data-driven decisions with confidence, while the human touch remains central to the final judgment.

Why Now? Preparing for the Future of Claims

With the impending departure of tenured staff in the insurance industry, insurers must prepare for a knowledge gap. Automation is not a future luxury; it’s a present necessity. By embedding deep knowledge and experience directly into AI models, insurers can ensure that expertise doesn’t retire with the workforce. Claims automation is an investment in efficiency, customer satisfaction, and operational resilience, setting insurers up for a future where speed and accuracy define competitive advantage.

Conclusion: Are You Ready for AI-Powered Claims Processing?

Insurance claims processing is evolving, and hybrid AI is at the forefront of this transformation. With expert.ai’s advanced claims automation solution, insurers gain more than just time savings; they unlock the ability to make faster, more informed decisions, enhance customer experiences, and tackle the rising complexities in claims management. The future of claims processing is here, and it’s powered by AI.

Is your organization ready to take the next step? By embracing a hybrid approach to AI, you can not only handle today’s claims volume with ease but also prepare for a more efficient, customer-centered future. Discover how expert.ai can help you build a streamlined, resilient, and future-ready claims process. Get in touch.

Transform Your Insurance Processes

With 30+ years of AI experience, expert.ai is the go-to partner for top P&C carriers worldwide. Our AI solutions streamline critical processes like underwriting and claims—giving you precision and control when it matters most.