Introduction

In the era of digital transformation, robotics and automation have revolutionized various sectors, including finance. Digital wallets have emerged as a popular and convenient way to manage financial transactions. Combining the power of robotics and digital wallets, especially through the use of Multi-Party Computation (MPC) wallets, offers a robust solution for automating financial transactions securely and efficiently. This blog post delves into the intersection of robotics and digital wallets, focusing on how MPC wallets can enhance the automation of financial transactions.

The Evolution of Digital Wallets

Digital wallets have transformed the way we handle financial transactions. They provide a convenient and secure method to store, send, and receive money, eliminating the need for physical cash or traditional banking methods. As the adoption of digital wallets grows, so does the potential for integrating advanced technologies to enhance their functionality.

Key Features of Digital Wallets

- Convenience: Digital wallets allow users to make transactions quickly and easily from their smartphones or other devices.

- Security: Advanced encryption and authentication methods protect user data and transactions.

- Integration: Digital wallets can integrate with various financial services, providing a comprehensive financial management tool.

- Accessibility: Users can access their funds and make transactions anytime, anywhere.

The Role of Robotics in Financial Transactions

Robotics, in the context of financial transactions, refers to the use of automated systems and robotic process automation (RPA) to handle repetitive and time-consuming tasks. These tasks can include transaction processing, fraud detection, customer service, and more. The integration of robotics into digital wallets can significantly enhance their efficiency and security.

Benefits of Robotics in Financial Transactions

- Efficiency: Automating financial transactions reduces processing times and minimizes human error.

- Cost Savings: Automation can lower operational costs by reducing the need for manual intervention.

- Scalability: Automated systems can handle a large volume of transactions, making them scalable for businesses of all sizes.

- Enhanced Security: Robotics can improve transaction monitoring and fraud detection, providing an additional layer of security.

Introduction to MPC Wallets

Multi-Party Computation (MPC) wallets represent a significant advancement in digital wallet technology. MPC wallets use a distributed approach to key management, enhancing security and privacy for users.

How MPC Wallets Work

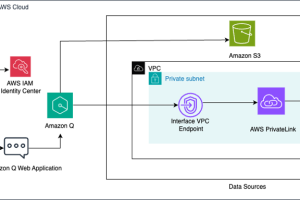

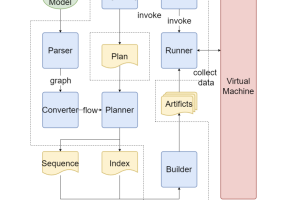

MPC wallet divides the private key into multiple shares, distributed among different parties or devices. These parties collaboratively compute transactions without ever reconstructing the full private key, ensuring that no single entity has complete control over the key at any time. This approach offers several benefits:

- Enhanced Security: By distributing key shares, MPC wallets eliminate single points of failure, making it significantly harder for attackers to compromise the key.

- Privacy Protection: The distributed nature of MPC ensures that sensitive information is not exposed to any single party, protecting user privacy.

- Fault Tolerance: MPC wallets can continue to operate even if some parties are compromised or go offline, ensuring uninterrupted access to funds.

Automating Financial Transactions with MPC Wallets and Robotics

The integration of robotics with MPC wallets creates a powerful framework for automating financial transactions. Here are some key ways in which this combination enhances the automation of financial transactions:

Secure and Efficient Transaction Processing

Robotic process automation (RPA) can streamline the processing of financial transactions by automating repetitive tasks. MPC wallets enhance this process by providing a secure framework for transaction authorization. This ensures that transactions are processed quickly and securely without the risk of a single point of failure.

Real-Time Fraud Detection

Robotics and AI algorithms can monitor transaction data in real-time to identify unusual spending patterns that may indicate fraudulent activity. MPC wallets further enhance this capability by securely processing transaction data, ensuring that fraud detection systems can respond quickly to potential threats.

Personalized Financial Management

Robotics can analyze user spending patterns and provide personalized financial recommendations. MPC wallets ensure that this sensitive financial data is processed securely and privately, allowing users to benefit from tailored financial advice without compromising their privacy.

Automated Compliance and Reporting

Financial institutions are required to comply with various regulatory requirements and report on financial transactions. Robotics can automate compliance and reporting processes, ensuring that all transactions are recorded accurately and in real-time. MPC wallets enhance this process by providing a secure and tamper-proof record of transactions.

Practical Applications of Robotics and MPC Wallets in Financial Transactions

Automated Payments and Transfers

Robotics can automate routine payments and transfers, such as bill payments, salary disbursements, and peer-to-peer transfers. MPC wallets provide a secure framework for these transactions, ensuring that payments are processed efficiently and without the risk of unauthorized access.

Investment Management

Robotics and AI can manage investment portfolios by analyzing market trends and making investment decisions based on predefined criteria. MPC wallets ensure that investment data is securely processed, protecting sensitive information and enhancing the security of investment transactions.

Expense Management

Robotics can automate expense tracking and management by categorizing transactions and providing real-time insights into spending patterns. MPC wallets enhance this process by ensuring that sensitive financial data is processed securely and privately.

Cross-Border Transactions

Robotics can streamline cross-border transactions by automating currency conversions and ensuring compliance with international regulations. MPC wallets provide a secure framework for these transactions, ensuring that funds are transferred efficiently and without the risk of unauthorized access.

The Future of Robotics and Digital Wallets

The future of financial transactions looks promising with the continued evolution of robotics and MPC wallets. As user data grows in volume and complexity, the need for secure and efficient transaction processing methods will only increase. MPC wallets, with their enhanced security and privacy features, are well-positioned to meet this demand.

Potential Developments

- Integration with Blockchain: Combining MPC wallets with blockchain technology can further enhance the security and transparency of digital transactions. Smart contracts can be used to automate and enforce transaction rules, while MPC ensures the confidentiality of transaction data.

- AI-Driven Financial Advisors: MPC wallets can be integrated with AI-driven financial advisory platforms, providing users with secure and personalized financial advice based on their spending behavior and financial goals.

- Decentralized Finance (DeFi): MPC wallets can play a crucial role in the growing DeFi ecosystem, enabling secure and private transactions on decentralized platforms.

- Cross-Border Financial Automation: Robotics and MPC wallets can facilitate secure and efficient cross-border transactions, enabling automation on a global scale.

Conclusion

The combination of robotics and digital wallets offers a powerful solution for automating financial transactions. MPC wallets enhance this process by providing a secure and private framework for transaction authorization and data processing. As the financial industry continues to evolve, the synergy between robotics and MPC wallets will play a crucial role in shaping the future of digital finance. By leveraging the strengths of both technologies, we can create a more secure, efficient, and automated financial ecosystem for users worldwide.